The analysis, compiled by the Assembly Republican Ways and Means Committee, found that Governor Paterson's 137 tax and fee increases - imposed on everything from digital music downloads to soda - could potentially lead to the loss of one-in-ten jobs.

These 137 tax and fee increases sought by Governor Paterson mean state government is digging even deeper into the pockets of New York's middle class families, many of whom are already reeling from the recession. His tax and fee hikes send absolutely the worst possible message, at the worst possible time, for middle class families who are losing their jobs, losing their houses and seeing their incomes and home values decline.

While families cut back and make sacrifices, Governor Paterson would have state government take even more, ultimately deepening and prolonging the recession. All these tax and fee hikes are like declaring war on New York's middle class families.

The following are some of the products and services Governor Paterson's Executive Budget would raise taxes or fees on: cable and satellite television; pay per view movies; cigars; discount coupons; haircuts; beauty salons; health clubs; weight loss programs; fishing; camping; malt-flavored beverages; digital music downloads; drinks from non-diet soda to Gatorade, Hawaiian Punch and Hi-C; beer; wine; car rentals; limousine services; taxis; movies; health

insurance; seed dealers; parents of children with special needs; boilers; explosives; horse entrance fees; sporting events; gasoline; clothing; jewelry; footwear; automobile purchases; registration and driving fees.

According to Stephen Kagann, former state chief economist, every $100 million in new taxes imposed during a recession leads to a loss of 11,400 private sector jobs. Governor Paterson's tax and fee hikes total $6 billion, meaning a loss of 600,000 jobs. When added to the administration's forecast of 180,000 jobs expected to be lost in 2009, it is a very real possibility that one-in-ten jobs in New York State could be threatened. That isn't doomsday - it's an economic apocalypse.

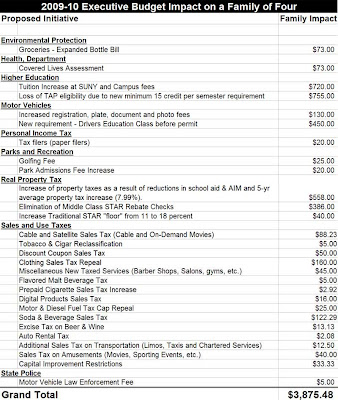

ITEMIZED BREAKDOWN OF THE $3,875.48 COST TO THE AVERAGE NEW YORK FAMILY FROM GOVERNOR PATERSON’S TAX AND FEE INCREASES.

(Click on the chart to enlarge)